Thanks for visiting The Smarter Investor. We have moved HERE for increased features and a (coming soon) better design. Feel free to leave comments or ideas here as the conversion is not fully complete.

www.thesmarterinvestor.org

Welcome, The Smarter Investor is here for sharing ideas and technical analysis. Main focus on equities but also bonds, options, and FOREX.

Tuesday, December 4, 2012

Tuesday, November 27, 2012

Forex Outlook

EURUSD

Short bias under 1.29264

GBPUSD

Short bias under 1.60067

USDCHF

Long bias over .93160

AUDUSD

Short bias under 1.04341

Short bias under 1.29264

GBPUSD

Short bias under 1.60067

USDCHF

Long bias over .93160

AUDUSD

Short bias under 1.04341

Amazon AMZN

Amazon's 237 resistance was broken last Friday. Today AMZN post a doji, signaling indecision. Look to the prior resistance are to turn support around 234-237. Target 250 for next resistance,

Another good short entry point S&P 500

Looks like the past support is turning into resistance around the 141.00 level of the SPY SPDR. Price is being rejected by the 50 EMA as well at 141. Short, target 135.

Monday, November 26, 2012

Flagstar Bancorp Inc. FBC

Flagstar has been on a tear since it's reverse split. They finally turned a profit 2nd quarter of 2012, and reported profit again in 3Q. Looking exhausted on weekly, could fall back to EMA's around 12.50, opening up a good entry point. Over 20 continued upside. Very bullish

Over 17 continued upside on daily.

Over 17 continued upside on daily.

Aegion Corp AEGN

Aegion has had a great run since October 2011. Recently price respected the weekly trend line around 17.90.

Looking at over 20 for a further upside push. Target 22.

Looking at over 20 for a further upside push. Target 22.

Ford Motor Company F

Ford found nice support on the retest of the $10.60 breakout late October. Long and strong

Good entry position over 11.15 on hourly.

Long term Head and Shoulders breakout and retest of neckline on weekly. Target $13

Good entry position over 11.15 on hourly.

Long term Head and Shoulders breakout and retest of neckline on weekly. Target $13

Financial SPDR XLF

Really in conflict over XLF. Broken 15.75 support seemed to turn into resistance last week. 20 EMA still over 50 EMA for a bullish bias. I'd like to seem over $16 for longs and under $15.50 for a short gap fill. Negative divergence on weekly.

First Solar, Inc. FSLR

FSLR holding strong today, closing up 3% at $25.53. Seems poised for a breakout over $26. Target $30. Could buy stock straight up or purchase $27 December calls, currently trading for $.73.

Arch Coal Inc. ACI

Looking to re-short ACI on a break of 6.30. Target of 5.75. Also bearish on the S&P 500 as the 1400 support area turns resistance.

Friday, November 23, 2012

SPY, Support turned resistance?

Will this broken support turn resistance? Or will we test the highs again? Let me know your thoughts.

Stock Twits

Happy Turkey Day all! Just set up a stock twits account this past week. Great site, you can follow me at @Armst227. Seems to enable me to show my positions more real time. Everyone should check it out.

StockTwits @Armst227

StockTwits @Armst227

Tuesday, November 20, 2012

Monday, November 19, 2012

Bank of America BAC

Long over $10.00 for long term.

Weekly look; over $10 confirms downtrend breakout, and breakout of recent channel formed since September.

Home Depot HD

HD has been on a bullish tear the past year, breaking out over 37.5 in December 2011. Looking for break of 63.50 for continuation. Might take an aggressive short under 59-60.

Gold and Silver

Will gold and silver continue their bullish run?

Over $34 in SLV long set up.

Over $174 long setup. Could get aggressive on long entry over $168.

Over $34 in SLV long set up.

Over $174 long setup. Could get aggressive on long entry over $168.

Sunday, November 18, 2012

Thursday, November 15, 2012

ACI Arch Coal Inc. Short

Almost went long ACI before the election but didn't want to risk it, good thing. False breakout above 8.50. Went short after Obama win, and gap down. In at 7.61 short. More pain to come, targets 6.25, 5.75, and 5.25. Expecting oversold bounce here in the future, presenting another short potential. Recent channel break.

Tuesday, September 11, 2012

Long Term CAT

I give this a FV of 120-130 from my FCF projections. Picked up some more here to double my position.

Monday, April 9, 2012

Cotton (BAL)

It's been a year since i was questioning the top in cotton around $110. Turned out I was correct but didn't act on my judgement, could have been some nice gains. Now I am questioning the bull case for cotton. On the daily it looks to be forming a double bottom. Looking for a break of the upper red resistance line.

Daily

Weekly

Daily

Weekly

SPY Options Straddle

I've been dabbling in options for a month or so now, most being paper trades. Here is one i am thinking about currently.

Strategy 1;

Buy 1 April 12 138 Call for $1.25 and Buy 1 April 12th 138 Put for $.71. Max loss $196. Upper BE $140, Lower BE $136.

Strategy 2;

Buy 1 May 12th 138 Call for $3.30 and Buy 1 May 12 138 Put for $2.71. Max loss $601. Upside breakeven is $144 and downside breakeven $132

Strategy 1;

Buy 1 April 12 138 Call for $1.25 and Buy 1 April 12th 138 Put for $.71. Max loss $196. Upper BE $140, Lower BE $136.

Strategy 2;

Buy 1 May 12th 138 Call for $3.30 and Buy 1 May 12 138 Put for $2.71. Max loss $601. Upside breakeven is $144 and downside breakeven $132

First Financial Northwest (FFNW)

FFNW still rocking out! Stop set at $6.90 now to lock in +30% profit. Buyers are still protecting the trend line, also forming a pinbar after today's close. Looking at the weekly chart, it looks ready to test the $8.50 level next. $$$$$$$$$$

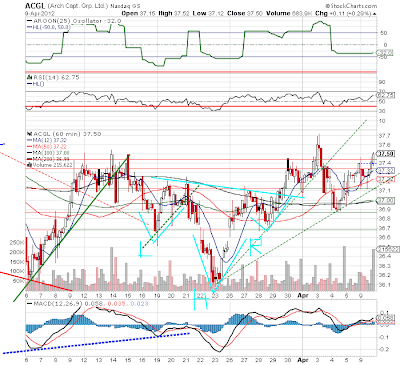

Arch Capital Group (ACGL) and XLK

Still holding XLK from AAPL conviction. I believe this will lead the market higher. It's been looking sick over the past week, but I'm holding based on my trading rules. Set stops and forget it. Support area in yellow.

Arch Capital has been traded sideways for what seems like forever now. I think this is longer term consolidation. Earnings might help it out on the 25th. Stop set at $35.50, looking for a retest of $38.

Wednesday, March 21, 2012

Technology ETF XLK

Went long a very small speculative position in XLK around $30. Very tight stops just under last support around $29.75. I like this because of apples new dividend announcement. Fund limited to dividend only stocks will now be scooping this up hand over fist. AAPL is 19% of XLK, followed closely by MSFT and IBM around 7%. Set and forget time. Risking only 2% of capital

Monday, March 19, 2012

LendingClub.com Alternate Investments

I recently got involved with peer-to-peer lending back in January through LendingClub.com, and my experience has been phenomenal. I invested a meager $500 just to play around with and because honestly I thought I would loose all or most of it. I lent to 10 different notes ranging from $20-$155, mostly choosing people with a B or better score trying to minimize credit card debt. I do have 2 E and F rated loans.

As of 3/19/12 I have received over $30 in interest and principal payments, with a net annualized return of 10.94%. The only downside was one note going through bankruptcy which is 120days overdue now. I blame this on myself for not taking more time looking into the borrower. All of the rest have been on time and perfect.

For anyone looking to get into some unusual alternative investments and willing to help another out of some nasty credit card debt or school loans, I recommend LendingClub.com. I suggest to do what I did and start with a very small amount of capital and expand. I'm now in the process of reinvesting my interest and couldn't be happier. Please do your own DD, and I hope my first person experience with LendingClub's services will help.

As of 3/19/12 I have received over $30 in interest and principal payments, with a net annualized return of 10.94%. The only downside was one note going through bankruptcy which is 120days overdue now. I blame this on myself for not taking more time looking into the borrower. All of the rest have been on time and perfect.

For anyone looking to get into some unusual alternative investments and willing to help another out of some nasty credit card debt or school loans, I recommend LendingClub.com. I suggest to do what I did and start with a very small amount of capital and expand. I'm now in the process of reinvesting my interest and couldn't be happier. Please do your own DD, and I hope my first person experience with LendingClub's services will help.

Tuesday, March 13, 2012

The chart I love SPY LT

This has surprisingly good accuracy for long term. Pair it with MACD. Good place to get bullish or bearish bias for smaller time frames. Awesome day for the S&P 500 closing at 1395.96!

Monday, March 12, 2012

SPY, MSFT, BLK

Got stopped out on Blackrock over the week, pretty bummed as I still think it has room to run with my bullish bias on the S&P.

Same for Microsoft. Lesson learned too aggressive on the stops. I'm looking to reenter MSFT at a break of $32. Looks like it is due for a breather, maybe even down to the $28 Jan breakout.

S&P broke resistance but still had a mediocre week. It is respecting the $135 support. I'm still very much bullish. Weekly Chart

Wednesday, February 29, 2012

2/29/12 Microsoft, Caterpillar, Blackrock, and Arch Capital

Microsoft looks beautiful still. Finding support at prior breakout. Recommended stops $31-$30.75.

Caterpillar lost some major support today. Look out below around $111 and $108. Should take action off of what the S&P does over next week.

Blackrock held support today after racing to touch resistance at $200. This could be a bearish signal. Watch out for $198 level support. Stops recommended at $195.

Arch Capital has gone sour and is looking more and more sick. Could be a good time to get short as it tests resistance. A break of this could restore some of my old faith.

Caterpillar lost some major support today. Look out below around $111 and $108. Should take action off of what the S&P does over next week.

Blackrock held support today after racing to touch resistance at $200. This could be a bearish signal. Watch out for $198 level support. Stops recommended at $195.

Arch Capital has gone sour and is looking more and more sick. Could be a good time to get short as it tests resistance. A break of this could restore some of my old faith.

Subscribe to:

Posts (Atom)