It's been a year since i was questioning the top in cotton around $110. Turned out I was correct but didn't act on my judgement, could have been some nice gains. Now I am questioning the bull case for cotton. On the daily it looks to be forming a double bottom. Looking for a break of the upper red resistance line.

Daily

Weekly

Welcome, The Smarter Investor is here for sharing ideas and technical analysis. Main focus on equities but also bonds, options, and FOREX.

Monday, April 9, 2012

SPY Options Straddle

I've been dabbling in options for a month or so now, most being paper trades. Here is one i am thinking about currently.

Strategy 1;

Buy 1 April 12 138 Call for $1.25 and Buy 1 April 12th 138 Put for $.71. Max loss $196. Upper BE $140, Lower BE $136.

Strategy 2;

Buy 1 May 12th 138 Call for $3.30 and Buy 1 May 12 138 Put for $2.71. Max loss $601. Upside breakeven is $144 and downside breakeven $132

Strategy 1;

Buy 1 April 12 138 Call for $1.25 and Buy 1 April 12th 138 Put for $.71. Max loss $196. Upper BE $140, Lower BE $136.

Strategy 2;

Buy 1 May 12th 138 Call for $3.30 and Buy 1 May 12 138 Put for $2.71. Max loss $601. Upside breakeven is $144 and downside breakeven $132

First Financial Northwest (FFNW)

FFNW still rocking out! Stop set at $6.90 now to lock in +30% profit. Buyers are still protecting the trend line, also forming a pinbar after today's close. Looking at the weekly chart, it looks ready to test the $8.50 level next. $$$$$$$$$$

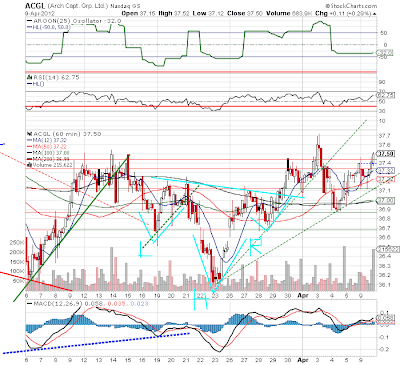

Arch Capital Group (ACGL) and XLK

Still holding XLK from AAPL conviction. I believe this will lead the market higher. It's been looking sick over the past week, but I'm holding based on my trading rules. Set stops and forget it. Support area in yellow.

Arch Capital has been traded sideways for what seems like forever now. I think this is longer term consolidation. Earnings might help it out on the 25th. Stop set at $35.50, looking for a retest of $38.

Subscribe to:

Posts (Atom)