Microsoft looks beautiful still. Finding support at prior breakout. Recommended stops $31-$30.75.

Caterpillar lost some major support today. Look out below around $111 and $108. Should take action off of what the S&P does over next week.

Blackrock held support today after racing to touch resistance at $200. This could be a bearish signal. Watch out for $198 level support. Stops recommended at $195.

Arch Capital has gone sour and is looking more and more sick. Could be a good time to get short as it tests resistance. A break of this could restore some of my old faith.

Welcome, The Smarter Investor is here for sharing ideas and technical analysis. Main focus on equities but also bonds, options, and FOREX.

Wednesday, February 29, 2012

Thursday, February 23, 2012

Aegion Corp. AEGN

AEGN hit some key levels this past week at around $19.00 on the weekly. Still firmly holding its uptrend from october.

Daily chart is also holding its uptrend line and looks to be ready to attempt to break the $189.97 high on 2/9/12. Tested 200MDA, rsi pointing higher, macd could be bottoming.

Hourly is stuck in a flag. Tomorrows action should give some more clues as to the direction. If a break and hold above $19.00 we could see $22.50 otherwise it should find support around $16.00

Daily chart is also holding its uptrend line and looks to be ready to attempt to break the $189.97 high on 2/9/12. Tested 200MDA, rsi pointing higher, macd could be bottoming.

Hourly is stuck in a flag. Tomorrows action should give some more clues as to the direction. If a break and hold above $19.00 we could see $22.50 otherwise it should find support around $16.00

Arch Capital Group ACGL

Whippppsawwww! Red circle is where i proclaimed the next leg up on Tuesday, and boy was I wrong as price continued to fall along the red downtrend line. A break of the red line support from the past breakout and I'll be running away. A break of $36 would be significant. $36 corresponds to a break of the 100MA on the daily chart as well. I remain bullish on this one and would like to get a break of the red resistance downtrend for a further move up.

Blackrock BLK

Blackrock got a nice breakout today over $197. Looks like its consolidating for the next leg up on the hourly to test 2011 highs of $200, provided the green dotted uptrend line holds. A breakout above here and we'll be looking for test of $215 then $230 (2010 highs).

Tuesday, February 21, 2012

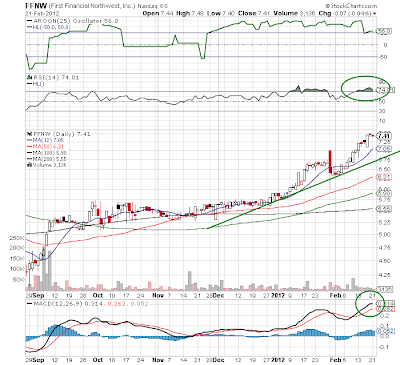

First Financial Northwest FFNW

This stock has been awesome over the past couple months. On the weekly its reaching 2010 highs of $7.50. Looking for a pullback.

This is confirmed on the daily as well. RSI well overbought and MACD looks toppy.

Looking for support on hourly around $7.30 or $7.00.

This is confirmed on the daily as well. RSI well overbought and MACD looks toppy.

Looking for support on hourly around $7.30 or $7.00.

Caterpillar CAT

Breakout today for CAT. Daily shows a break of $14.50 May 2011 highs. It feel in the late afternoon trading to test the breakout closing with an inverted hammer. RSI pretty overbought and MACD showing weakness on daily.

The breakout looks really good on the hourly, holding in the late afternoon. Looks ready to go up tomorrow. RSI pointing up and MACD could negate its recent weakness with more strength tomorrow.

The breakout looks really good on the hourly, holding in the late afternoon. Looks ready to go up tomorrow. RSI pointing up and MACD could negate its recent weakness with more strength tomorrow.

Arch Capital Group ACGL

This looks ready to go on hourly. Break of downtrend, and MACD looking to cross.

Still looking for a solid break above $38. Hopefully MACD holds on daily and we see some above average volume. Buyers have been protecting this under $37.50. EPS was .92 vs. .65 expected on 2/14/12.

Still looking for a solid break above $38. Hopefully MACD holds on daily and we see some above average volume. Buyers have been protecting this under $37.50. EPS was .92 vs. .65 expected on 2/14/12.

A look back on Blackrock BLK

Since July BLK has fallen through support and retested 2010 lows in October 2011. That would have called for a great buying opportunity because now price has returned back to 2010 highs. Ive been left holding the bag somewhat on this one due to the wild ride 2011 turned out to be. The retest of this highs seem strong this rally, we are up almost 2% after hours at $198. Look for a test of the 2010 highs of $215-$230 area.

Annaly Capital Management NLY

Gotta love Annaly Capital Management with their 13% yield. This is a long term hold of mine and looks ready to make a move. NLY broke out early February from almost 5 months of consolidation and recently retested this trend line. MACD seems to be bottoming and rsi > 50. I will be looking for it to retest the highs on the weekly chart around 17.30. If it breaks out this would confirm to me a new uptrend and put away the idea of a double top as seen on the weekly. Below this I would look to add more, don't want to miss any divys on this one

Subscribe to:

Posts (Atom)